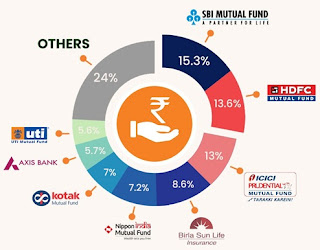

India's mutual fund industry comprises several prominent Asset Management Companies (AMCs) that offer a diverse range of investment schemes. Here are some of the top mutual fund companies in India, based on their Assets Under Management (AUM):

| AMC Name | AUM (₹ Crore) | Number of Schemes | Highest Returns (%) |

|---|---|---|---|

| SBI Mutual Fund | 10,38,335 | 143 | 32.52 |

| ICICI Prudential Mutual Fund | 8,88,210 | 284 | 35.94 |

| HDFC Mutual Fund | 7,55,913 | 161 | 43.28 |

| Nippon India Mutual Fund | 5,40,387 | 269 | 27.87 |

| Kotak Mahindra Mutual Fund | 4,69,822 | 208 | 34.70 |

| Aditya Birla Sun Life Mutual Fund | 3,79,312 | 250 | 25.32 |

| UTI Mutual Fund | 3,25,730 | 240 | 37.25 |

| Axis Mutual Fund | 3,09,513 | 240 | 28.64 |

| Tata Mutual Fund | 1,82,086 | 165 | 33.11 |

| DSP Mutual Fund | 1,79,583 | 161 | 29.96 |

These AMCs have established a strong presence in the Indian mutual fund market, offering a variety of schemes catering to different investment objectives and risk appetites. When selecting a mutual fund, it's crucial to consider factors such as the fund's historical performance, expense ratio, fund manager's expertise, and alignment with your financial goals.

For a comprehensive analysis and comparison of mutual fund schemes, platforms like Value Research provide detailed insights into various funds and their performance metrics.

Post a Comment