What is a Mutual Fund?

Mutual Funds are pooled investment vehicles actively managed either by professional fund managers or passively tracked by an index or industry. The funds are generally well diversified to offset potential losses. They offer an attractive way for savings to be managed in a passive manner without paying high fees or requiring constant attention from individual investors. Mutual funds present an option for investors who lack the time or knowledge to make traditional and complex investment decisions. By putting your money in a mutual fund, you permit the portfolio manager to make those essential decisions for you.

How does a mutual fund operate?

A mutual fund company collects money from several investors, and invests it in various options like stocks, bonds, etc. This fund is managed by professionals who understand the market well, and try to accomplish growth by making strategic investments. Investors get units of the mutual fund according to the amount they have invested. The Asset Management Company is responsible for managing the investments for the various schemes operated by the mutual fund. It also undertakes activities such like advisory services, financial consulting, customer services, accounting, marketing and sales functions for the schemes of the mutual fund.

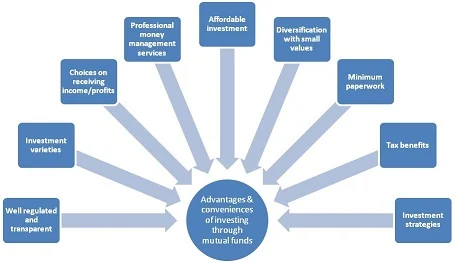

Benefits of investing in mutual funds:

Professional Management

When you invest in a mutual fund, your money is managed by finance professionals. Investors who do not have the time or skill to manage their own portfolio can invest in mutual funds. By investing in mutual funds, you can gain the services of professional fund managers, which would otherwise be costly for an individual investor.

Diversification

Mutual funds provide the benefit of diversification across different sectors and companies. Mutual funds widen investments across various industries and asset classes. Thus, by investing in a mutual fund, you can gain from the benefits of diversification and asset allocation, without investing a large amount of money that would be required to build an individual portfolio.

Liquidity

Mutual funds are usually very liquid investments. Unless they have a pre-specified lock-in period, your money is available to you anytime you want subject to exit load, if any. Normally funds take a couple of days for returning your money to you. Since they are well integrated with the banking system, most funds can transfer the money directly to your bank account.

Flexibility

Investors can benefit from the convenience and flexibility offered by mutual funds to invest in a wide range of schemes. The option of systematic (at regular intervals) investment and withdrawal is also offered to investors in most open-ended schemes. Depending on one’s inclinations and convenience one can invest or withdraw funds.

Low transaction cost

Due to economies of scale, mutual funds pay lower transaction costs. The benefits are passed on to mutual fund investors, which may not be enjoyed by an individual who enters the market directly.

Transparency

Funds provide investors with updated information pertaining to the markets and schemes through factsheets, offer documents, annual reports etc.

Well regulated

Mutual funds in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which endeavors to protect the interests of investors. All funds are registered with SEBI and complete transparency is enforced. Mutual funds are required to provide investors with standard information about their investments, in addition to other disclosures like specific investments made by the scheme and the quantity of investment in each asset class.

Mutual Funds are pooled investment vehicles actively managed either by professional fund managers or passively tracked by an index or industry. The funds are generally well diversified to offset potential losses. They offer an attractive way for savings to be managed in a passive manner without paying high fees or requiring constant attention from individual investors. Mutual funds present an option for investors who lack the time or knowledge to make traditional and complex investment decisions. By putting your money in a mutual fund, you permit the portfolio manager to make those essential decisions for you.

How does a mutual fund operate?

A mutual fund company collects money from several investors, and invests it in various options like stocks, bonds, etc. This fund is managed by professionals who understand the market well, and try to accomplish growth by making strategic investments. Investors get units of the mutual fund according to the amount they have invested. The Asset Management Company is responsible for managing the investments for the various schemes operated by the mutual fund. It also undertakes activities such like advisory services, financial consulting, customer services, accounting, marketing and sales functions for the schemes of the mutual fund.

|

| What Are The Benefits of Investing in a Mutual Fund |

Benefits of investing in mutual funds:

Professional Management

When you invest in a mutual fund, your money is managed by finance professionals. Investors who do not have the time or skill to manage their own portfolio can invest in mutual funds. By investing in mutual funds, you can gain the services of professional fund managers, which would otherwise be costly for an individual investor.

Diversification

Mutual funds provide the benefit of diversification across different sectors and companies. Mutual funds widen investments across various industries and asset classes. Thus, by investing in a mutual fund, you can gain from the benefits of diversification and asset allocation, without investing a large amount of money that would be required to build an individual portfolio.

Liquidity

Mutual funds are usually very liquid investments. Unless they have a pre-specified lock-in period, your money is available to you anytime you want subject to exit load, if any. Normally funds take a couple of days for returning your money to you. Since they are well integrated with the banking system, most funds can transfer the money directly to your bank account.

Flexibility

Investors can benefit from the convenience and flexibility offered by mutual funds to invest in a wide range of schemes. The option of systematic (at regular intervals) investment and withdrawal is also offered to investors in most open-ended schemes. Depending on one’s inclinations and convenience one can invest or withdraw funds.

Low transaction cost

Due to economies of scale, mutual funds pay lower transaction costs. The benefits are passed on to mutual fund investors, which may not be enjoyed by an individual who enters the market directly.

Transparency

Funds provide investors with updated information pertaining to the markets and schemes through factsheets, offer documents, annual reports etc.

Well regulated

Mutual funds in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which endeavors to protect the interests of investors. All funds are registered with SEBI and complete transparency is enforced. Mutual funds are required to provide investors with standard information about their investments, in addition to other disclosures like specific investments made by the scheme and the quantity of investment in each asset class.

Post a Comment